Etsy QuickBooks Self-Employed Integration Sales Tax Issues (and how to fix it)

Here’s a quick way to save some money when you file your Etsy Taxes 😊

Did you know that when you integrate Etsy and QuickBooks Self Employed that the orders that come over from Etsy include the sales tax that Etsy collected???

This is not good…

You know why?

Sales tax that you collect is NOT taxable income aka….you should NOT be paying income taxes on sales tax!

It’s a common problem that I see a lot of sellers asking about and even worse, a common problem that a lot of sellers are TOTALLY unaware of…

If you ever wondered about the QuickBooks Self-Employed and Etsy integration, especially regarding sales tax AND wanted to know how to fix it, then you are in the right place!

Now I am hoping at this point that you are aware that Etsy collects the sales tax for you!

But just because Etsy collects the sales tax for you, does NOT mean that you should be overpaying your INCOME tax when you link your Etsy and QuickBooks Self Employed.

So, today I am going to walk you through

- A really brief overview of sales tax and what it means to your shop (for WAY more info and state by state instruction, check out my “Get Legit Kit” right here)

- How to spot the issue when Etsy adds in sales tax to your QuickBooks Self Employed and what it means

- How to fix this issue so that you will NOT be overpaying come tax time.

Now, first things first, let’s get into a really brief overview of Etsy Sales Tax.

Back in 2018 there was a national decision called the “Wayfair vs South Dakota 2018” lawsuit where South Dakota was getting kind of annoyed that this giant corporation Wayfair, Inc. kept shipping a bunch of products to residents in their state WITHOUT having to pay any South Dakota sales tax.

Without boring you too much, the court ruled that states can mandate businesses to charge and remit sales tax to states OTHER then the ones they are physically located in.

Or in simple terms we can all understand…

…. before this ruling, if you had a business in Pennsylvania and sold a product in Colorado you didn’t have to charge sales tax….the states did not like this…they were missing out on HUGE amounts of tax revenue each year…

What this meant for Etsy sellers was that we now needed to charge sales tax to ALL of the states, not just the ones we were located in..

This now became a HUGE mess.

I am talking about a gigantic mess, because who in their right minds know what sales tax rate to charge to different states and how to actually pay it back to the states in which they charged.

Trying to charge sales tax to 50 different states and having to keep track of how much to charge and when to charge it…no thanks.

Fast forward a couple of years and in steps the “big boys” to help us out a bit…

I am talking about Etsy, Amazon, Ebay, etc…

All of these online “marketplaces” started to ease the burden for their sellers and THEY took the reigns and started to charge sales tax FOR their sellers (most states anyway) AND they started to pay the sales tax for their sellers.

The ruling made it mandatory for marketplaces (Etsy, Amazon, Ebay) to collect sales tax on behalf of their sellers and then the marketplaces would be responsible for paying back that sales tax to the state.

So why I am saying all of this?

To explain this one point right here….

Sales tax is neither an expense NOR is it income for Etsy Sellers.

It is really just you (or Etsy now) collecting sales tax, holding it for a little bit, and then paying it back to the state.

To think about it simply, you are basically just holding the sales tax for the state for a certain period of time until the state wants it back.

The reason that this is so important to understand is that again sales tax is NOT an expense (tax deduction) and it is NOT income.

The other reason (and the point of this article) that this is important to understand is because when you link your Etsy and QuickBooks self-employed, Etsy, for some odd reason, pulls in your TOTAL sales which INCLUDES sales tax.

And if you are following along, we know that sales tax is NOT income and it is not an expense so this means that when we link our Etsy and QuickBooks Self-Employed that we are actually counting MORE income than is necessary.

To think about it like this, the average sales tax rate is 5%, so if you know at this point that Etsy adds in the total sales tax to your QuickBooks and we know that sales tax is NOT income to us…do you really want to pay 5% more in taxes then you need to?

Didn’t think so…

Now, before we move onto the next step, just because Etsy collects and pays the sales tax for you that does NOT mean you are done.

You may still need to file sales tax forms and obtain a sales tax license.

For a state by state breakdown, along with some other important info, check out this link right here.

Now let’s move onto the next step…

How To Spot The Issues When You Integrate Etsy and QuickBooks Self-Employed

For this section, I am going to share some screen shots with you so you can see firsthand….

I am going to use a real-life Etsy Sellers that links to QuickBooks Self Employed so you can see what I mean.

Now, this is not going to be a tutorial on how to use QuickBooks Self Employed for Etsy or go into much detail other then the sales tax side.

Back to the topic…

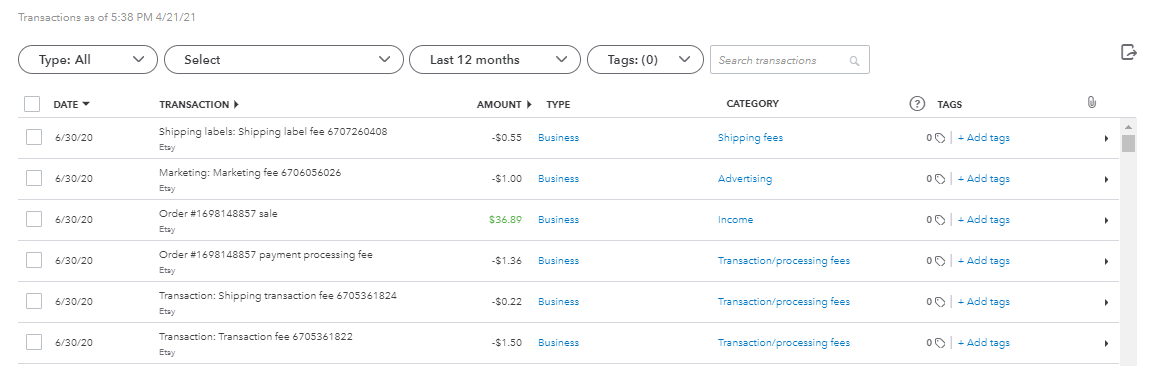

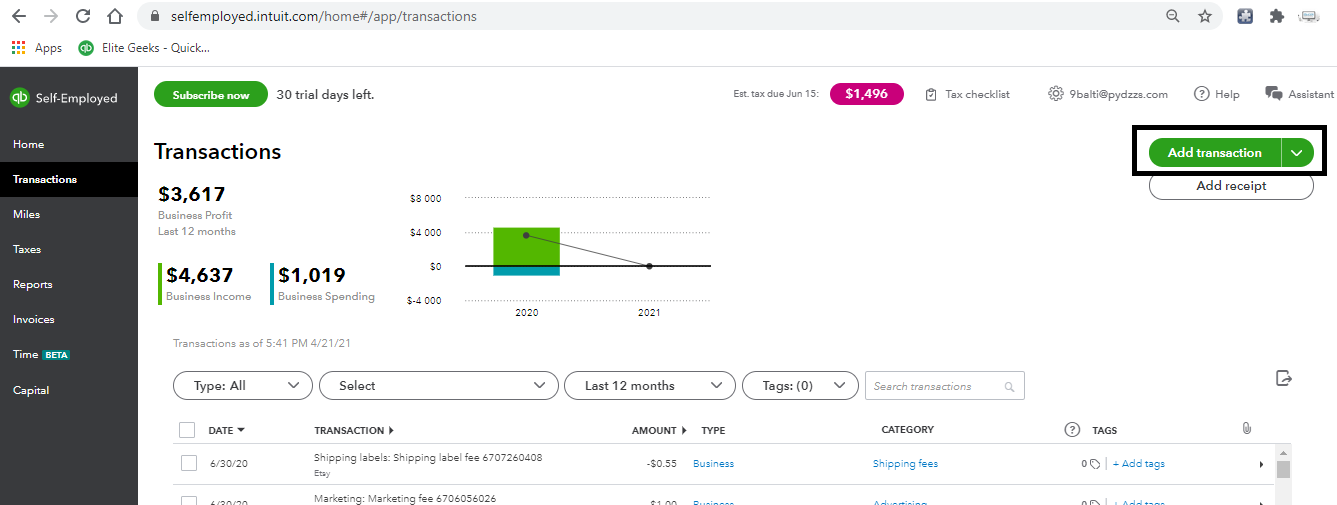

When you integrate QuickBooks Self Employed with Etsy, here is what your “transactions” tab will look like.

What Etsy does is it brings over all of your data and then you need to “add” it into QuickBooks Self-Employed for Etsy to start generating reports

Let’s go over a real example…

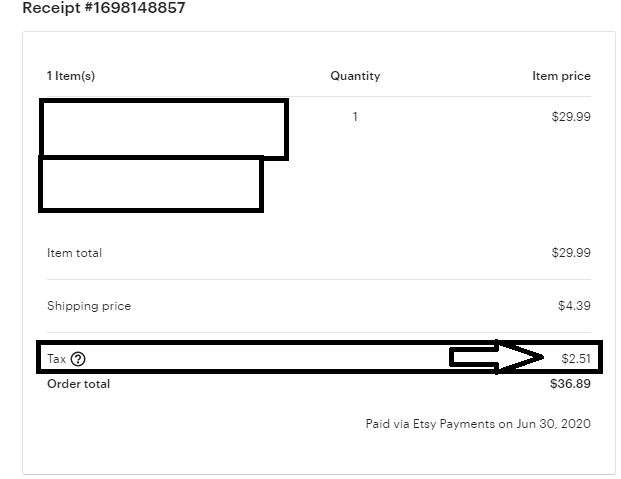

As you can see, there is an order #1698148857 for $36.89

Where the issue comes in is that when I search this order number in my Etsy Shop and I look at this individual order, it will include sales tax…

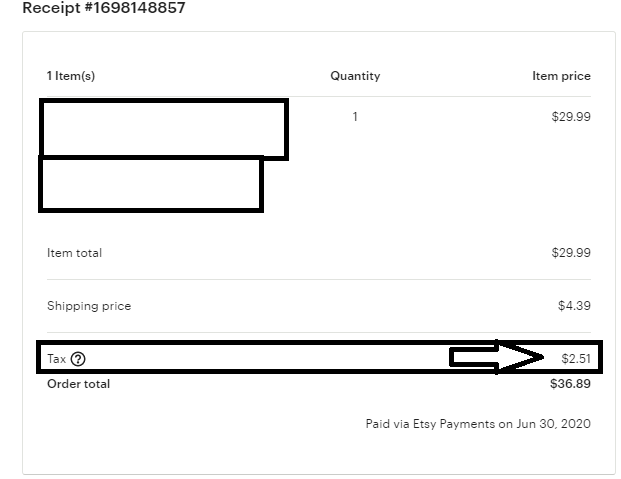

Take a look at my screenshot below

You can see that the total here is $36.89 BUT it includes sales tax and as we know by now, sales tax is NOT income….

Now this is a problem, because if I go into QuickBooks Self Employed for Etsy and click “income” then it will pick up the FULL $36.89 and I will be paying taxes on this amount….

Again, we do NOT want to do this….

A very brief overview on taxes is this…

You take your total income and subtract out all of your expenses and this leaves you with what is called Net Income. The Net Income is ultimately what you pay taxes on.

Now, if you can see the problem here, it is that the total amount of “sales” that comes over from the Etsy to QuickBooks integration it will include sales tax…and if it includes sales tax and sales tax is NOT income then really we are OVERREPORTING our income ☹

This seems to be an issue with the integration right now AND IT AFFECTS EVERY SINGLE SALE…this is important to note because it is just not one or two sales it is EVERY SINGLE integrated sale that comes over…

As far as I know there is really no plan on changing this and if you call Etsy or QuickBooks…well they are not really sure either…

But luckily you are still reading this article and you will know how to fix it…

Which brings us over to the third step in the process…

How To Fix The Issue So We Will Not Be Overpaying Our Etsy Taxes

I know what you are thinking “Finally dude, the damn solution”

I wish it was easier to explain, but it my opinion it makes sense to get an idea of first why we should NOT be doing it, figuring out how to realize it’s there and then fixing the problem 😊

Ok, so the moment we have all been waiting for…

How to fix the Etsy sales tax and QuickBooks self-employed sales tax problem…

By now we know the issue….

Etsy brings over the TOTAL amount of the sales and it INCLUDES sales tax.

Now, what we want to do is to REDUCE our total amount of taxable income BY the sales tax amount.

The easiest way to do this is exactly like this….

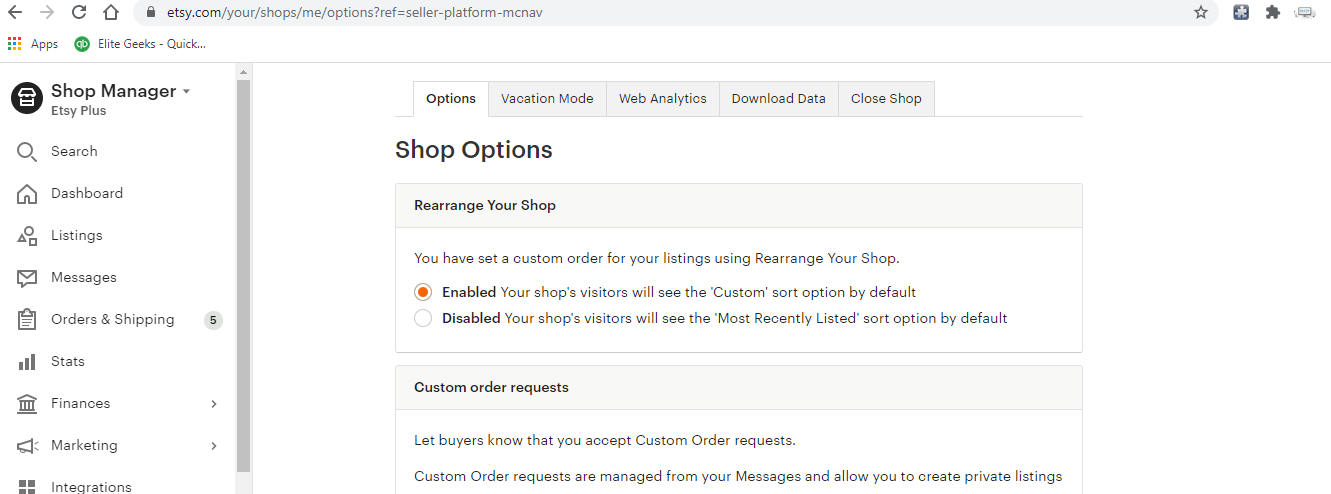

Let’s first start off by going to our Shop Manager in Etsy.

Once we are here, we want to go to “Settings” and then we want to go to “Options” and then at the top of this page you will see “Download Data”

It should look like this

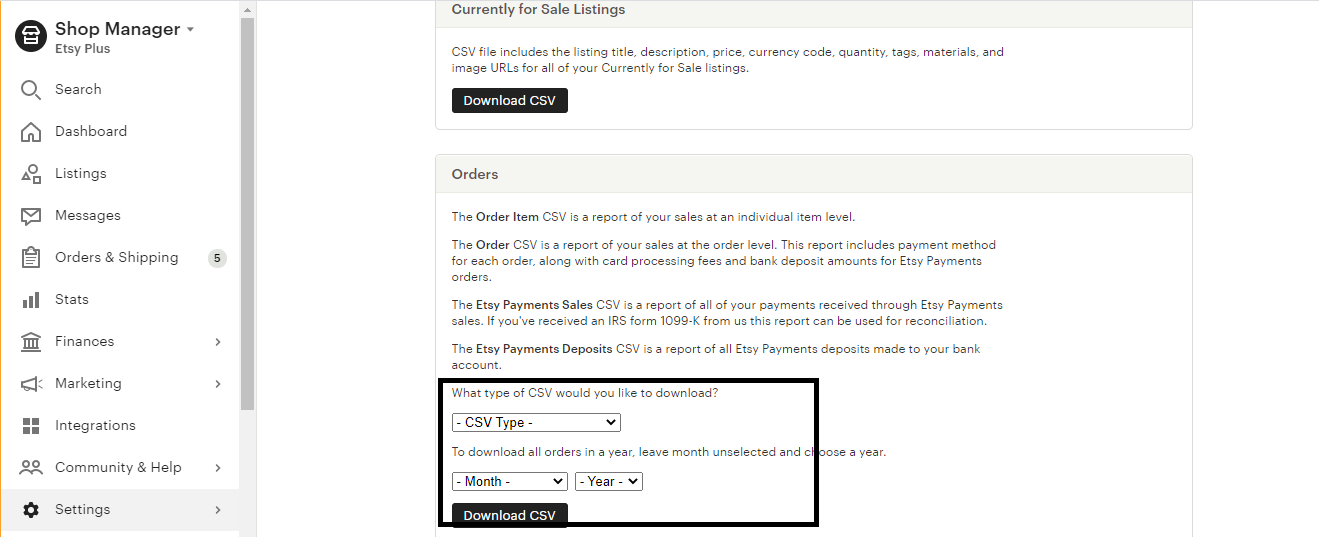

What we want to do next is click the “download data” tab

It is going to look like this

Now, AND THIS IS VERY IMPORTANT

The file type we are going to choose is Etsy Payment Sales and the next thing we need to choose is the date.

Just a note on the date….

If you are “catching up” for the entire year then just select the year you need to do this for…

If you are doing it month by month then just select the month.

The reason the dates are important is because we want to “match” the total amount of sales tax collected for the period we are working on.

If you can remember from up above, every time Etsy brings over an order to QuickBooks Self-Employed it also brings over the sales tax collected for the order. The time periods matter because if we are doing this month to month, then we need to follow this process below for the month we are working on.

Meaning, if June just ended and we are doing our June bookkeeping, then the report we will want to pick above will be June 2020.

If you wait until once a year to do your bookkeeping, then you will need to do this one time for the entire year.

If you are sporadic, then you will just need to remember the LAST time you did this (but don’t worry) we will go over more of this later on….

Let’s say we are just doing one month at a time and it just so happens that in my example above, the example sale took place on June 30th 2020 and since we know from above that this integration between QuickBooks and Etsy sales tax issues happens on EVERY SINGLE sale then we will need to adjust for every single sale.

The easy way to do this without going one by one by one by one and wasting hours is to just do this one time in a “bulk” way and what I mean by that is this…

Instead of selecting every order on our Etsy QuickBooks Self Employed and “splitting” the transactions, we only need to make ONE adjustment and we do it like this….

From the Etsy Sellers Report above all we need to do is select the right month and click “Download CSV”.

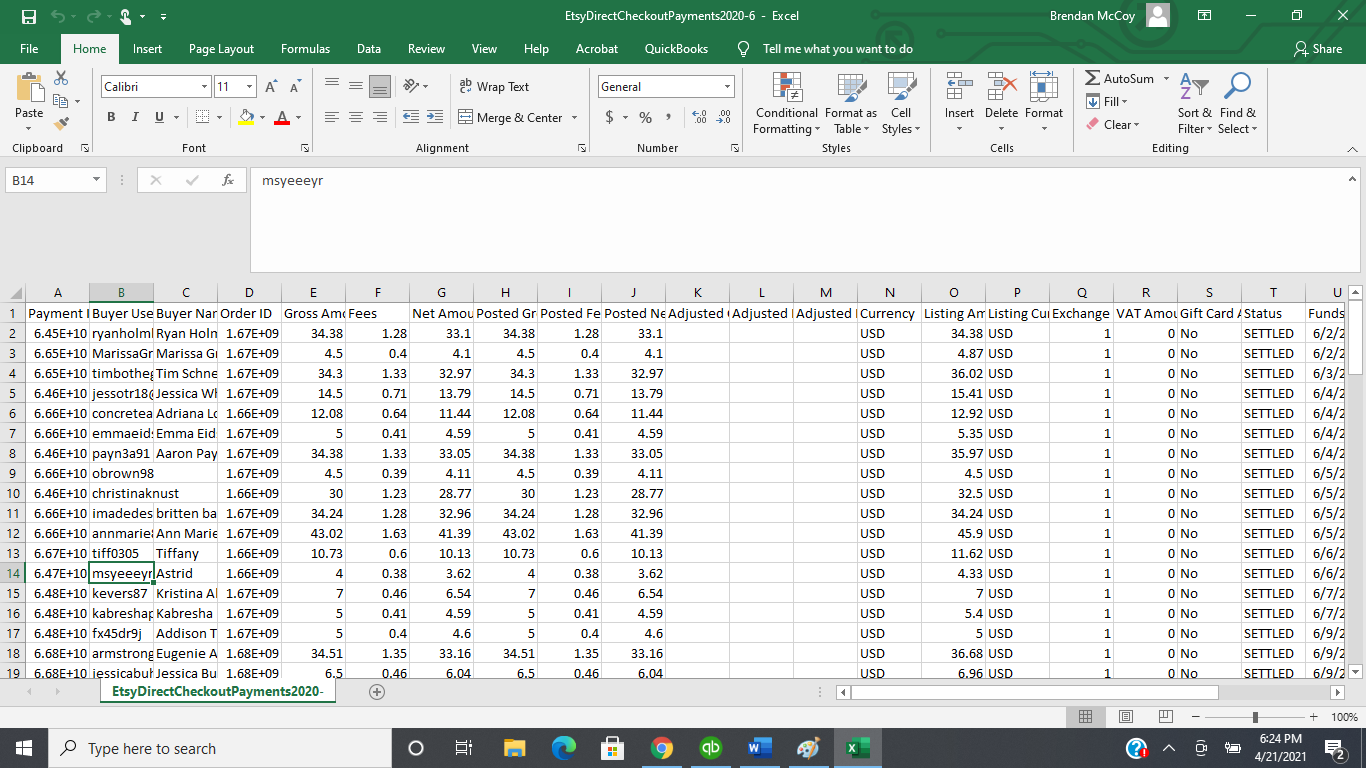

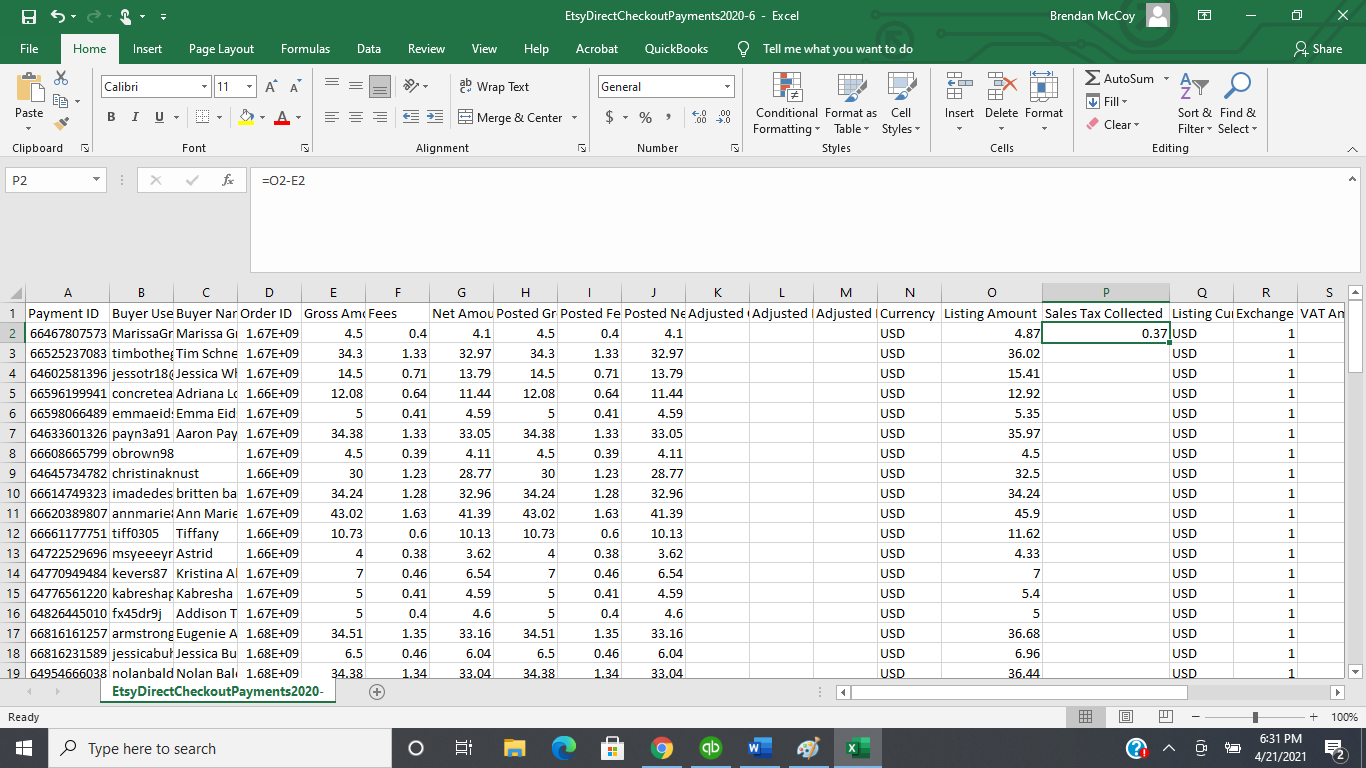

It will open up an excel file that looks like this…

Now, as I am sure you may know, this Etsy Sellers Report is pretty intimidating with LOTS and LOTS of numbers and columns. But, there are only two columns we need to focus on and that is column “O” or “Listing Amount” and column “E” or “Gross Amount”.

Let’s look at these two columns from my Etsy Seller’s Report.

As you can see, at the very bottom of this sheet is the order we were looking at above.

The $36.89 (what came into Quickbooks from Etsy) is listed in “column O” and it is my listing amount and the “gross amount” in column E is $34.38.

Now here’s a magic trick…

So, these two numbers are obviously different…

And the difference between column O and column E is the SALES TAX COLLECTED BY ETSY….

Or $36.89 (listing amount/what Etsy brings into QuickBooks) MINUS $34.38 (actual amount of taxable income) = $2.51 (my sales tax collected on that order)

If we double check that individual order

Boom!

$2.51 in both places…

Now there are only a couple of other steps left to do to fix this problem…

The first step is that we need to do this simple calculation for EACH order…

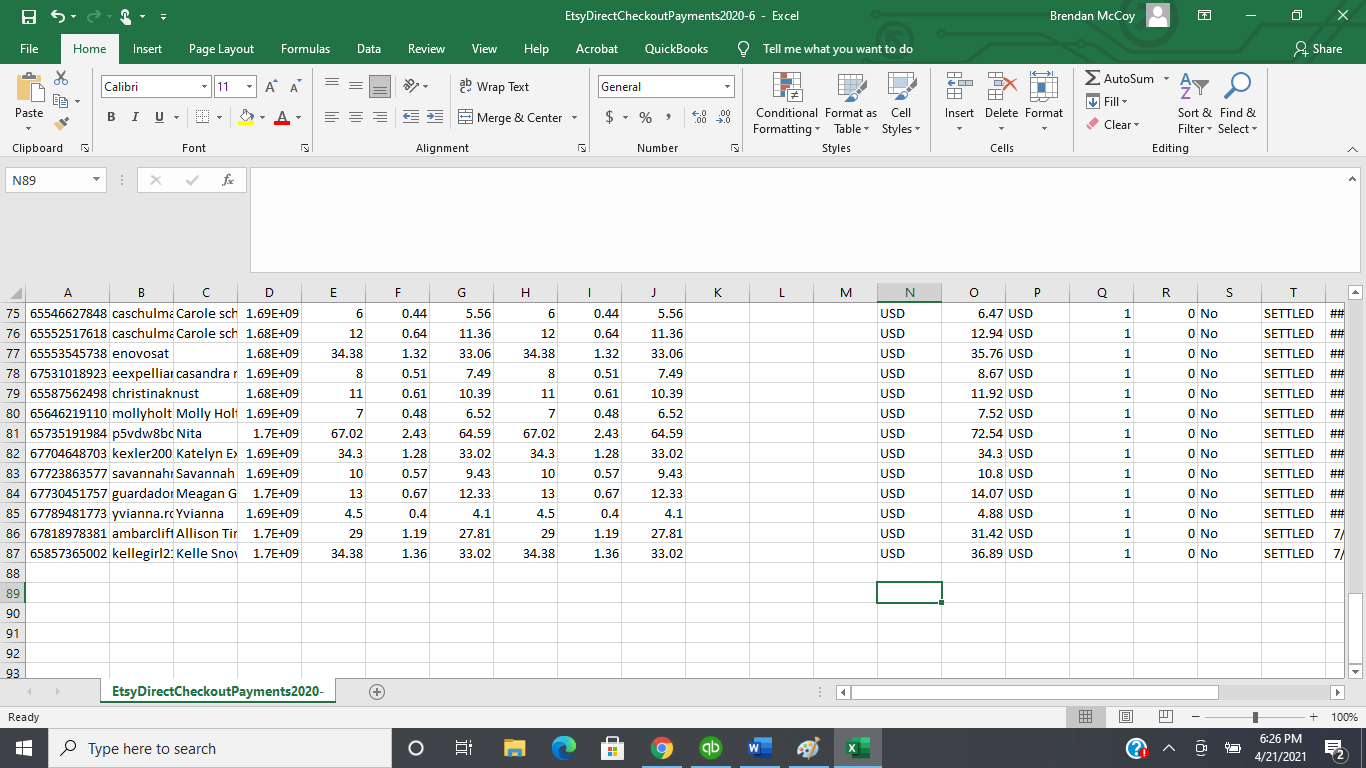

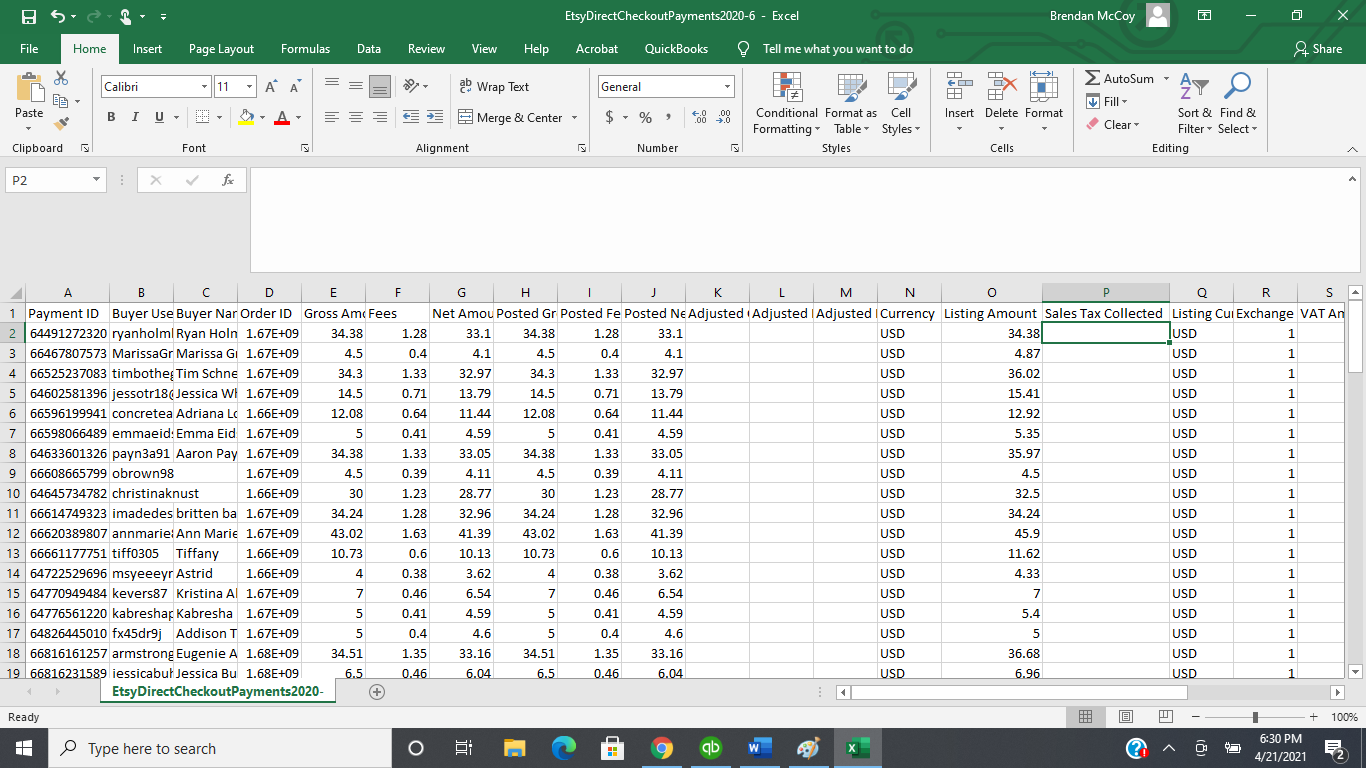

The easy way to do this in the Etsy Sellers Report is just add an extra column after column O and call it “sales tax collected.

Like so…

Then what I would do is enter this really simple formula

You type in the empty cell “=O2-E2”

Like this

When you hit enter it will spit out the difference between these two cells.

Now all you need to do is just drag this formula all the way down….

If you are not sure how to “drag” the formula down, on the bottom right you are going to see what looks like a square, just click on that and drag down.

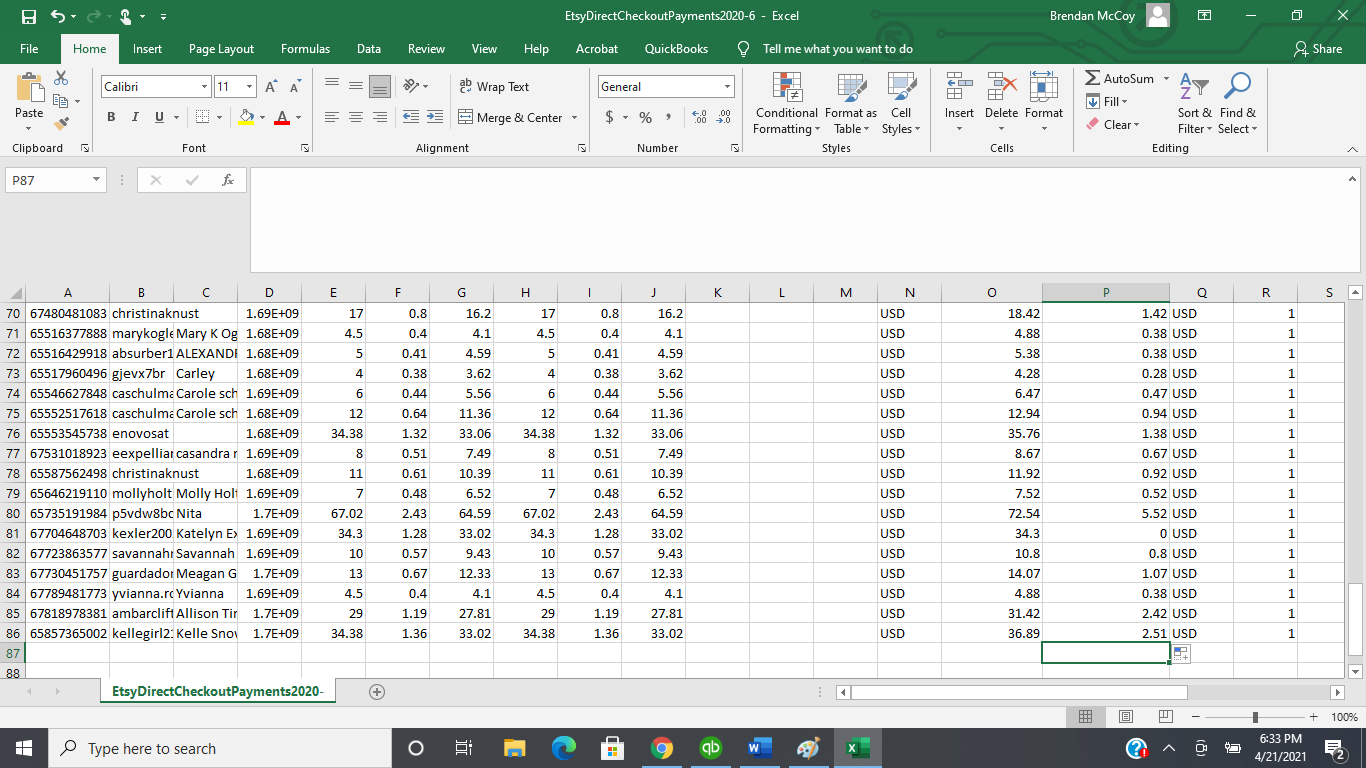

Once you drag down in the Etsy Sellers Report you will populate every single cell.

It will look like this

All you need to do now is just “sum” up all of column P and voila, it will give you the total amount of sales tax collected for the month….or in this case $96.30.

This $96.30 is the TOTAL amount of sales tax collected for June.

The last step we need to do is just enter this amount in Etsy QuickBooks Self Employed like this…

Let’s move over into QuickBooks Self Employed in the transactions tab and click on “Add Transaction”

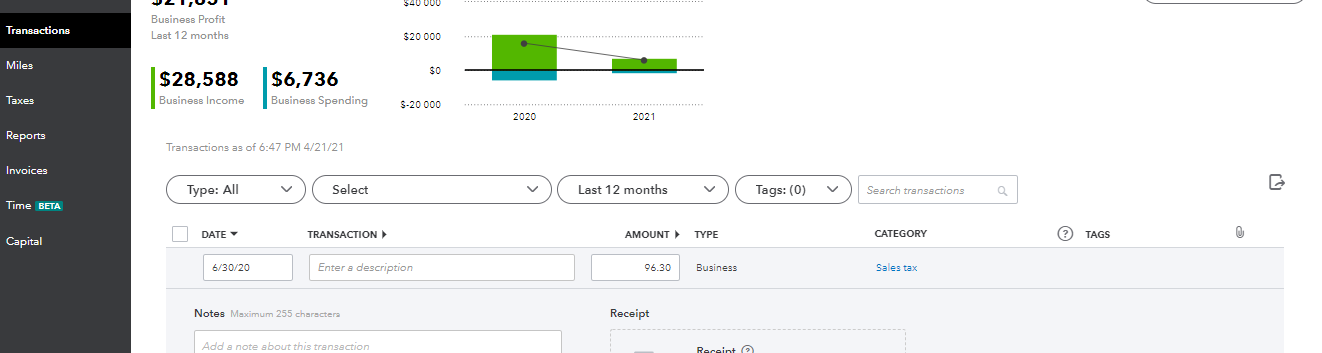

Once we click this button it will open the screen to add in this extra transaction manually and all we need to do is this…

Enter the date (I would put the end of the month we are working on, in this case 6/30)

Enter the amount (this is the sum from the Etsy Sellers Reports on Sales Tax)

The category will be “Sales Tax”

It should look like this…

All you need to do after this is just click “save” and you are done!

And that’s it…. you just added in the sales tax you collected into your QuickBooks Self Employed for Etsy….

There is one more major note before I get into something else…..

When you go to do your taxes, please, please, please remember that Sales Tax is NOT a business expense.

When you add in the sales tax manually this way, it will indeed reduce you overall net income, however, it will show up on its OWN line item on the profit and loss report….AS AN EXPENSE and we know that sales tax is neither an EXPENSE nor is it INCOME.

What this means is that it did NOT reduce your total “sales” on your report, all it did was reduce your total net income.

When you go to file your taxes, what I would do is just take your total “sales” or total “income” and then subtract this total amount of sales tax collected to get your true “sales”.

There are some limitations with QuickBooks Self-Employed for Etsy and this is one of them.

Unfortunately, you can not make this number a “negative” number to reduce your sales, it has to go on its own line item and you will have to remember that once the year is over you just simply take your total sales MINUS this sales tax item and the difference between these two will be your total “sales” your report on your tax return.

Alright, so that wraps up this article on Etsy Accounting with regards to Etsy Sales Tax Collected and the Integration Etsy has with QuickBooks.

If you want to watch me do this live, I suggest you take a look at my Instagram (@etsyaccounting) as I have an entire video dedicated to this along with other helpful hints and tricks.

If you liked what you read here and want even more info on Etsy Accounting, Etsy Bookkeeping, Etsy QuickBooks and overall Etsy Business help, click the link below to download some of my free info.

Grab all my free stuff right here!